Business

การที่จะหาของดีนั้นเป็นเรื่องที่ไม่ยาก อยู่ที่คนหามากกว่าว่าจะสามารถหาเจอหรือไม่ ของดีอาจจะมีอยู่ทั่วไป ยกตัวอย่างง่ายๆ คุณไปเดินตลาดนัดเสื้อผ้ามือสอง แล้วมีเสื้อแบรนด์เนมชื่อดัง กองรวมอยู่ในนั้น ถ้าคนที่ไม่มีความรู้ หรือคนที่ไม่รู้จักแบรนด์นี้มาก่อน คุณก็เห็นเป็นแค่เสื้อผ้าธรรมดา

สำหรับใครที่กำลังสนใจจะจดทะเบียนตั้งบริษัท ก็คงคิดเหมือนกันใช่หรือไม่ว่าการจดทะเบียนบริษัทถือเป็นหลักการสำคัญที่สุดในการเริ่มต้นธุรกิจเป็นอย่างมาก เนื่องจากว่าการจดทะเบียนบริษัทได้เปิดโอกาสให้กับหลายๆอย่างในบริษัทของคุณเอง ไม่ว่าจะเป็นการได้รับเงินทุนที่น่าสนใจของทางภาครัฐ หรือบางครั้งที่มีการจัดสัมมนาที่จัดขึ้นโดยรัฐก็สามารถส่งพนักงานเข้าไปรับการสัมมนาหรืออบรมได้โดยไม่ต้องเสียค่าใช้จ่าย นี่เองจึงเป็นเหตุผลที่หลายๆคนอยากจดทะเบียนเพื่อก่อตั้งบริษัท แต่ก่อนที่จะก่อตั้งบริษัทและจดทะเบียนสิ่งที่ต้องรู้เป็นอันดับแรกมีดังต่อไปนี้ 1.การพิจารณาเรื่องจำนวนผู้ก่อตั้งธุรกิจ สิ่งแรกที่หลายคนอาจไม่รู้ก็คือจำนวนของผู้ก่อตั้งธุรกิจที่ทางกฎหมายกำหนดไว้ โดยแต่ก่อนหน้านี้จะกำหนดให้ต้องมีจำนวนผู้ก่อตั้งธุรกิจอย่างน้อย 3 คน และผู้ก่อตั้งธุรกิจเรานั้นจะต้องจองซื้อหุ้นไว้อย่างน้อยคนละ 1 หุ้น แต่ในความเป็นจริงแล้วปัจจุบันนี้เพราะมีการเปิดการค้าเสรีของอาเซียนจึงส่งผลให้ไม่จำเป็นต้องมีผู้ก่อตั้งธุรกิจ 3 คนอีกต่อไปโดยทางกฎหมายได้อนุโลมให้มีผู้ก่อตั้งบริษัทแค่เพียงหนึ่งคนก็เพียงพอแล้ว 2.จำเป็นแค่ไหนสำหรับข้อมูลผู้ถือหุ้น อีกหนึ่งอย่างที่หลายคนอาจไม่เคยรู้มาก่อนก็คือข้อมูลผู้ถือหุ้นนั่นเอง โดยข้อมูลผู้ถือหุ้นมีหลายๆสิ่งที่ต้องระบุเอาไว้ไม่ว่าจะเป็นชื่อและนามสกุลรวมไปถึงที่อยู่และสัญชาตินอกจากนี้ยังจะต้องใส่ข้อมูลของจำนวนผู้ถือหุ้นแต่ละคนอีกด้วย 3.การจดทะเบียนบริษัทจำเป็นต้องมีพยาน จุดนี้น่าจะเป็นข้อมูลใหม่ที่คนก่อตั้งบริษัทหรือคนที่อยากก่อตั้งบริษัทอาจไม่เคยรู้มาก่อนโดยคุณจำเป็นจะต้องมีข้อมูลพยาน ซึ่งข้อมูลของพยานได้แก่การกรอกชื่อรวมไปถึงนามสกุล รวมไปถึงเลขของบัตรประชาชนชื่อและที่อยู่ที่สำคัญต้องใส่วันเกิดไปด้วย 4.รายละเอียดในการจัดประชุมเพื่อก่อตั้งบริษัท สำหรับสิ่งที่จะต้องมีไม่แพ้กันก็คือรายละเอียดในการก่อตั้งบริษัทจุดเด่นของการก่อตั้งคือจะต้องมีการประชุมและหารือก่อนเป็นอันดับที่ 1 หลังจากนั้นก็จะมีข้อมูลของผู้สอบบัญชี ซึ่งจะมีการกรอกทั้งชื่อและนามสกุล รวมไปถึงเลขทะเบียนสำหรับผู้สอบบัญชีและค่าตอบแทนอีกด้วย ในรายละเอียดการประชุมต้องมีการระบุกรรมการที่มีอำนาจลงชื่อในบริษัทของเราและจะต้องดูว่ามีตราประทับหรือไม่ถ้ามีตราประทับอาจจัดทำตรายางด้วยก็ดีเช่นกัน และนี่ก็คือสาระน่ารู้เกี่ยวกับการจดทะเบียนบริษัท หากว่าใครที่อยากจะก่อตั้งบริษัท แนะนำว่าให้สืบค้นข้อมูลดังต่อไปนี้ รับรองได้เลยว่าจะไม่ผิดหวังที่ตัดสินใจก่อตั้งบริษัทอย่างแน่นอน

อุตสาหกรรมบบ้านขงเรานั้นมีเครื่องมือมากมายในการใช้งาน ซึ่งบางอุตสาหกรรมที่จะมีเครื่องมือให้เราได้เห็นเยอะแยะเลยด้วยเช่นกัน ซึ่งอุปกรณ์บางชิดนั้นดูไม่สำคัญอะไรเลย แต่ความจริงแล้ว นั้นมีความสำคัญอย่างมากนะครับ ในบทความนี้เรามาดูกันดีกว่านะครับว่าว่าอุตสาหกรรม กับเครื่องมืออะไรบ้างที่ดูไม่สำคัญ แต่จริงแล้ว มีความสำคัญมาก เครื่องวัดอุณหภูมิ หลายคนนั้นอาจจะยังไม่รู้ว่าภายในโรงงานอุตสาหกรรมนั้นมีการวัดอุณหภูมิด้วยนะครับ ซึ่งดูเหมือนว่าจะเป็นอุปกรณ์ที่ไม่สำคัญอะไรเลยใช่ไหมครับ ? กับเครื่องวัดอุณหภูมิ แต่จริง ๆ แล้ว เครื่องมือวัดอุณหภูมินั้นมีความสำคัญต่ออุตสาหกรรมหลาย ๆ โรงงานมากเพราะว่าบางอุตสาหกรรมนั้นจะมีการวัดอุณหภูมิในผลผลิต หรือ ในการผลิตนั้นจะต้องมีอุณหภูมิที่แน่นอน เพื่อมาตรฐานของการผลิต ดังนั้นจึงเป็นอีกหนึ่งนวัตกรรม และ เครื่องมือที่สำคัญอย่างมากภายในอุตสาหกรรมเลยนะครับ เครื่องวัดความชื้น หลายคนนั้นอาจจะสงสัยว่าเครื่องวัดความชื้นนั้นมีบทบาทสำคัญอะไรในอุตสาหกรรม ซึ่งบทบาทของเครื่องดูดความชื้น หรือ เครื่องวัดความชื้นนั้นมีความสำคัญต่ออุตสาหกรรมอย่างมากเลยนะครับไม่ว่าจะเป็นในเรื่องของขั้นตอนการผลิตเอง หรือ แม้แต่การรักษาคุณภาพเองก็มีการใช้งานในเรื่องของ เครื่องวัดความชื้นเองก็สำคัญอย่างมากนะครับ เพราะว่าจะช่วยในหลากหลายขั้นตอนอย่างมาก นอกจากนั้นยังมีในเรื่องของความปลอดภัยจากความชื้นด้วยนะครับ ยกตัวอย่างเช่น ห้องแลป ที่มีการวัดความชื้น เพื่อป้องกันอุบัติเหตุจากความชื้นได้ด้วยเช่นกัน เครื่อง เครื่องวัดรังสี หลายคนนั้นอาจจะยังไม่รู้นะครับว่าในการเลือกใช้สารเคมีนั้นเกือบจะทุกโรงงานอุตสาหกรรมนั้นจะมีการใช้สารเคมีด้วยนะครับ ซึ่งบางทีนั้นในอุตสาหกรรมนั้นจะมีการใช้สารเคมีอย่างหลากหลาย และ ทำหใหลายคนนั้นยังไม่รู้ว่าถ้าหากว่าเรานั้นมีการนำเข้าสารเคมีที่มากเกินไปนั้นจะเป็นอันตรายต่อร่างกายอย่างมากนะครับ ดังนั้นในบางอุตสาหกรรมนั้นจึงมีการใช้เครื่องวัดรังสีเพื่อใช้ในการวัดรังสีนะครับ ซึ่งปลอดภัยสำหรับพนักงานอย่างมกา และ หลายคนนั้นอาจจะยังไม่รู้ว่ามีความสำคัญขนาดไหนนะครับ เครื่องวัดเสียง และ ความดัง ในอุตสาหกรรมบางส่วนนั้นจะมีเสียงที่ดังอย่างมาก ซึ่งจะเป็นอันตรายต่อหูของเราด้วยเช่นกัน […]

ปัจจุบันโรงงานนั้นเป็นหนึ่งในส่วนประกอบสำคัญของประเทศไทย มีจังหวัดมากมายที่มีนิคมอุตสาหกรรมขนาดใหญ่อยู่ และที่นั้นจะต้องมีพนักงานหลายร้อย หลายพันคนกว่าแน่นอน และทุกท่านที่อ่านอยู่เคยเกิดความสงสัยไหมครับว่าทำไมโรงงานนั้นหาพนักงานรับทำความสะอาดมาจากไหน ซึ่งจริง ๆ แล้วมีบริษัทรับจ้างทำความสะอาดอยู่แต่วันนี้เราจะมาพูดถึงข้อดีของการเลือกใช้บริษัทรับทำความสะอาดในโรงงานกันดีกว่าครับ พนักงานทั้งหมดไม่ต้องโฟกัสที่ความสะอาด พนักงานทำความสะอาดหรือ บริการรับทำความสะอาดนั้นจะช่วยให้พนักงานทั้งหมด หรือพนักงานทั้งร้อย หรือ พันกว่าชีวิต นั้นไม่จำเป็นต้องมาโฟกัสงานทำความสะอาดเลยแม้แต่น้อยเพราะทุกคนจะสามารถเอาเวลามาโฟกัสที่งานของตัวเองได้ทันที โดยที่ไม่จำเป้นต้องคิดถึงเรื่องความสะอาด งานเสร็จได้ดีขึ้น อย่างที่กล่าวไปว่าหากเราทำงานโดยที่โฟกัสเพียงแค่งานอย่างเดียว โอกาสที่เราจะทำงานได้สำเร็จได้ง่ายขึ้น โดยที่ไม่ต้องห่วงเรื่องความสะอาดนั้นจะทำให้งานที่ได้รับมอบหมายนั้นสำเร็จได้ง่ายขึ้น สุขภาพดีขึ้น การมีสภาพแวดล้อมที่ดี นั้นจะช่วยให้สุขภาพดีมากขึ้น ไม่ใช่แค่สุขภาพร่างกายที่ดีขึ้น แล้วยังพูดถึงสุขภาพจิตที่ดีขึ้นด้วยเช่นกัน ดังนั้นการมีสภาพแวดล้อมที่ดีก็จะช่วยให้มีสุขภาพร่างกายที่ดีและสุขภาพจิตที่ดีก็พร้อมจะไปต่อในเรื่องของการทำงานด้วยนะครับ บรรยากาศดีขึ้น ไม่ว่าจะที่ทำงาน หรือ ออฟฟิศคงไม่มีใครอยากให้สถานที่ที่เราทำงานอยู่นั้นสกปรกหรอกนะครับ เพราะนอกจากจะลดสุขภาพของเราแล้วยังพาให้บรรยากาศรอบข้างนั้นไม่ดีอีกด้วยดังนั้นหากว่าที่ทำงานของเราสะอาดมากเท่าไหร่ บรรยากาศรอบข้างก็จะดีขึ้นด้วยเช่นกัน เห็นไหมครับว่าการมีบรรยากาศที่ดี ที่ทำงานที่สะอาดนั้นจะช่วยเราได้อย่างมากมาย และมีข้อดีมากมายที่เราควรจะเลือกใช้บริการรับทำความสะอาด เพื่อบรรยากาศที่ดีมากขึ้นในรอบตัวเรานะครับ และสำหรับโรงงาน ที่ยังขาด แม่บ้านทำความสะอาดอยู่ ต้องการใช้บริการ แม่บ้านมืออาชีพ ผู้เขียน ขอแนะนำ บริการทำความสะอาดโรงงาน ของ T&T FUJI เพราะนอกจากจะราคาไม่แพงแล้ว พนักงานยังมีความเป็นมืออาชีพอีกด้วย อ่านรายละเอียดเพิ่มเติมได้ที่ […]

ธุรกิจร้านอาหารในปัจจุบันนั้นได้เพิ่มจำนวนมากขึ้น ซึ่งก็จะมีทั้งร้านอาหารที่เป็นแบบให้นั่งกินที่ร้าน และร้านอาหารที่ให้ซื้อกลับบ้านหรือ Take home เท่านั้น แต่มีอีกธุรกิจร้านอาหารหนึ่งที่น่าสนใจเลยทีเดียว นั่นก็คือร้านอาหารแบบ ฟู้ดทรัค (Food truck) ร้านอาหารแบบฟู้ดทรัคคือร้านอาหารที่ขายบนรถโดยการนำร้านอาหารมาไว้บนรถนั่นเอง ซึ่งรถที่ใช้ก็จะเป็นทั้งรถสามล้อและสี่ล้อ โดยสามล้อฟู้ดทรัคราคาก็จะย่อมเยากว่าแบบสี่ล้อ และสี่ล้อหรือสามล้อฟู้ดทรัคราคาก็จะมีความแตกต่างกันออกไปขึ้นอยู่กับขนาดรูปทรงของรถคันนั้น ๆ ข้อดีของร้านอาหารแบบฟู้ดทรัค (Food Truck) ข้อแรกเลยสำหรับเจ้าของร้านนั้นตัวรถฟู้ดทรัคสะดวกสบายในการเคลื่อนย้าย โดนถ้าเป็นร้านขายแบบที่ต้องไปตั้งร้านตั้งโต๊ะขายก็จะทำให้เสียเวลาในการจัดตั้งร้านและเก็บของกลับ แต่สำหรับตัวฟู้ดทรัคนั้นทุกอย่างอยู่บนรถครบหมดแล้วสามารถเคลื่อนที่ไปขายได้เลย โดยไม่ต้องเสียเวลาในการจัดตั้งร้านหรือเก็บของมากนัก สามารถขายที่ไหนก็ได้ ถ้าเป็นร้านอาหารปกติเราก็ต้องล็อคที่ตั้งไว้เลยว่าร้านเราอยู่ตรงนี้ชัดเจน แต่สำหรับฟู้ดทรัคแล้วเราสามารถขับไปขายที่ไหนก็ได้ อย่างเช่นตามตลาดนัดหรือสถานที่มีคนเยอะๆ ไม่ต้องมีปัญหาในเรื่องของสัญญาเช่าร้าน แน่นอนรถฟู้ดทรัคไม่ต้องเสียค่าเช่าร้านเป็นรายเดือนหรือรายปีแบบร้านที่ขายเป็นล็อคที่แน่นอน จึงทำให้หมดปัญหาในเรื่องของสัญญาเช่า สร้างการจดจำได้ง่าย การขายอาหารแบบฟู้ดทรัคนั้น รถแต่ละคันก็ต้องมีไอเดียในการตกแต่งร้านให้ออกมาดึงดูดลูกค้า แต่งรถให้น่าสนใจ เช่นถ้าทำฟู้ดทรัคขายพิซซ่า (Pizza) ก็อาจจะตกแต่งรถให้ออกมาเป็นรูปพิซซ่า (Pizza) ที่น่ากิน และทำให้มีเอกลักษณ์โดดเด่นให้คนจดจำได้ง่าย ข้อดีอีกข้อหนึ่งคือสามารถต่อยอดธุรกิจได้สบาย ถ้าหากฟู้ดทรัคของเราเป็นที่จดจำในตลาด ลูกค้าจำแบรนด์ของเราได้ เราสามารถขยายสาขาของฟู้ดทรัคหรือทำแฟรนไชส์ให้คนมาซื้อไปขายได้อีกด้วย นอกจากข้อดีข้างต้นแล้วนั้นข้อสำคัญในการขายอาหารแบบฟู้ดทรัคคือเราต้องเลือกรถฟู้ดทรัคที่มีคุณภาพดีและราคาย่อมเยา โดยรถสี่ล้อหรือสามล้อฟู้ดทรัคราคาก็จะแตกต่างกันออกไป สามล้อฟู้ดทรัคมีขนาดเล็กกว่าสี่ล้อดังนั้นสามล้อฟู้ดทรัคราคาอาจจะถูกกว่า ทั้งนี้ก็ขึ้นอยู่กับเจ้าของร้านฟู้ดทรัคว่าต้องการรถแบบไหนโดยทั้งรถสี่ล้อฟู้ดทรัคหรือสามล้อฟู้ดทรัคราคาก็จะขึ้นอยู่กับขนาด , ดีไซน์รถ และคุณสมบัติของแต่ละประเภทเป็นสำคัญ

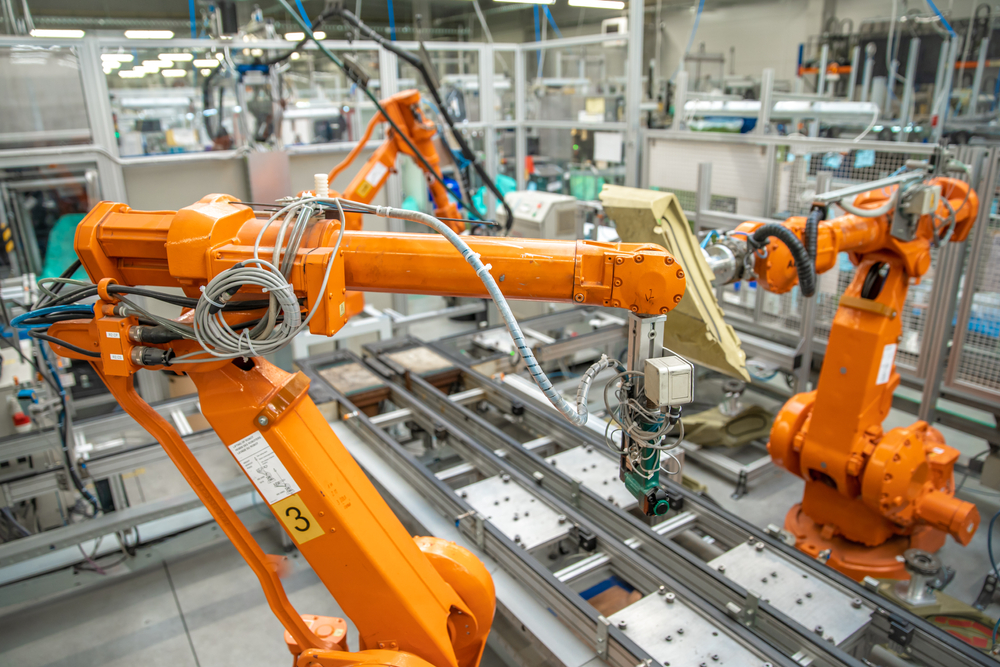

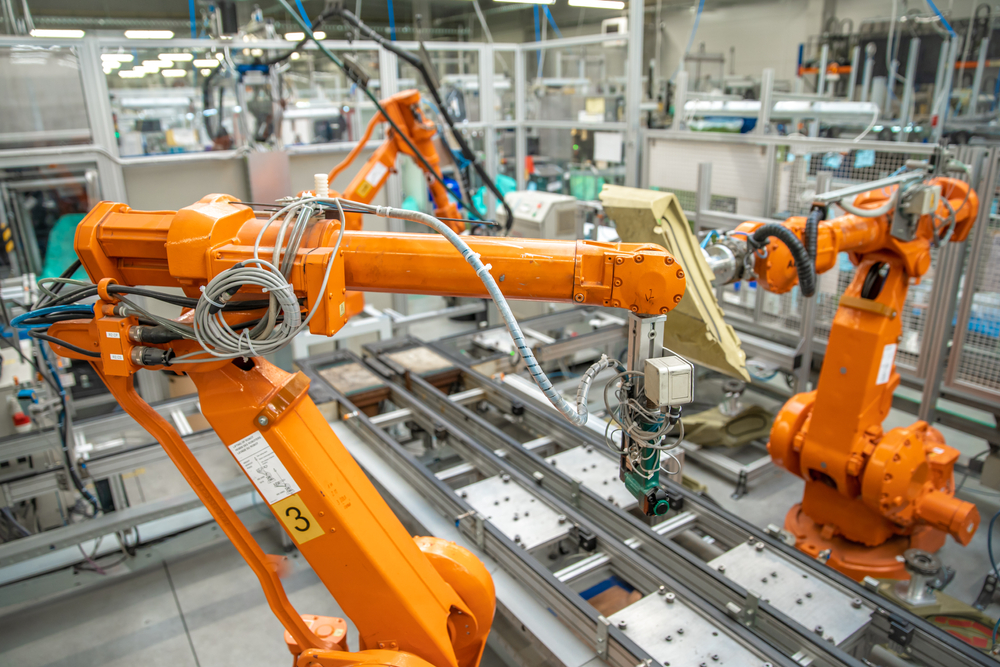

บทความนี้ เราจะมีแนวทางสู่การดำเนินการออกแบบระบบ automation ให้ประสบความสำเร็จมาฝาก ซี่ง เรารับรองเลยว่า หากเพื่อนๆ ได้อ่าน บทความนี้ต้องเป็นประโยชน์ต่อเพื่อนๆ อย่างแน่นอน 6 แนวทางสู่การดำเนินการออกแบบระบบ automation ให้ประสบความสำเร็จ จำเป็นอย่างยิ่งที่จะต้องควบคุมกระบวนการผลิตของตนเองให้มีประสิทธิภาพสำหรับทุกแผนงาน Automation เพื่อให้สามารถใช้ประโยชน์จากข้อดีที่จะได้รับในแง่ของประสิทธิภาพการทำงาน เนื่องจากชิ้นส่วนแต่ละชิ้นมีจำนวนมากมายมหาศาล มีรูปทรงแบบต่างๆ รวมไปถึงขนาดที่แตกต่างกัน ทำให้การผลิตสร้างเครื่องมือมีชิ้นส่วนที่เหมือนกันจำนวนน้อยมาก ‘มาตรฐานที่จำเป็น’ ขององค์ประกอบต่าง ๆ และกระบวนการที่จำเป็นสำหรับการใช้โซลูชันระบบอัตโนมัติจึงยังขาดแคลนในบริษัทสร้างเครื่องมือในระดับหนึ่ง ในการทำให้กระบวนการ Automation เป็นไปได้ ชิ้นส่วน เครื่องมือและฐานข้อมูลการผลิตควรพร้อมใช้งานตามขั้นตอนทั้งหมด บริษัทที่ถูกสำรวจได้ดำเนินการตามขั้นตอนแรกในเรื่องนี้ด้วยการใช้แท็ก RFID เพื่อระบุส่วนประกอบต่าง ๆ โดยอัตโนมัติ ขั้นตอนต่อไปเกี่ยวข้องกับการเข้าถึงข้อมูลที่ได้รับ การใช้งานอย่างต่อเนื่องเพื่อให้ระบบอัตโนมัติสามารถทำงานต่อไปได้ การมีส่วนร่วมอย่างจริงจังของพนักงานในโครงการระบบอัตโนมัติ (Automation Project) เป็นสิ่งจำเป็นอย่างยิ่งต่อความสำเร็จ และสามารถพิสูจน์ได้ว่า เป็นแรงจูงใจสำหรับแผนการอื่น ๆ ต่อไป บริษัทต้องเชื่อมต่อเครื่องจักรอื่นๆ เข้าด้วยกันโดยใช้ฮาร์ดแวร์ automation เพื่อสร้างกระบวนการอัตโนมัติที่จะช่วยให้สามารถจัดเตรียมวัสดุและใช้งานได้ การใช้เครื่องจักรเชื่อมประสานกันได้แบบสม่ำเสมอได้เกิดขึ้นเฉพาะในช่วงเวลาสั้น ๆ ในการสร้างเครื่องมือของเยอรมนีจนถึงปัจจุบัน และเวลานี้ก็ยังมีความแตกต่างกันอย่างมากในเรื่องของระดับของระบบอัตโนมัติระหว่างกระบวนการผลิตของแต่ละส่วนงาน และสุดท้าย คือ […]

ในปัจจุบันนี้โรงงานอุตสาหกรรมนั้นมีขนาดใหญ่มากมายด้วยกันที่เราเองควรที่จะให้ความสนใจและความสำคัญอย่างมากที่สุด ในตอนนี้พวกโรงงานอุตสาหกรรมขนาดใหญ่หรือขนาดเล็กนั้นก็ย่อมที่จะใช้มอเตอร์เกียร์นั้นเป็นส่วนหนึ่งในการทำอุตสาหกรรมเพราะว่ามอเตอร์เกียร์คืออุปกรณ์ที่ใช้สำหรับควบคุมรอบการทำงานของการเคลื่อนที่วัตถุได้อย่างดี มอเตอร์เกียร์จะใช้ในอุตสาหกรรมขนาดใหญ่คือการลำเรียงสินค้าโดยอาศัยการแปลงจากมอเตอร์ไฟฟ้าให้เป็นพลังงานกลทำให้วัตถุนั้นสามารถที่จะเคลื่อนที่ได้และฟันเฟืองนั้นสามารถที่จะทำหน้าที่ได้ลดรอบความเร็ว ลักษณะของมอเตอร์เกียร์จะลักษณะคล้ายๆกับท่อนโลหะทรงกระบอกที่ประกอบไปด้วยตัวเรือน หน้าแปลนและก้านพลายื่นออกมาและด้านในก็มีกลไกต่าง ๆอีกมากมายด้วยกัน ในปัจจุบันนี้มอเตอร์เกียร์นั้นมีหลากหลายรูปแบบเลยที่เราเองไม่ควรที่จะมองข้าม อะไรที่เราคิดว่าสำคัญนั้นในการทำให้เครื่องจักรอุตสาหกรรมนั้นทำงานได้ดีก็คงไม่พ้นมอเตอร์เกียร์ ทุก ๆอย่างนั้นเป็นเรื่องที่เราเองจะต้องใส่ใจอย่างมากและไม่ควรที่จะมองข้ามอีกด้วย หลากหลายเรื่องราวนั้นเป็นเรื่องที่สำคัญและจำเป็นอย่างมากที่สุดในการที่เราจะใช้ในการทำอุตสาหกรรม ไม่ว่าอุตสาหกรรมที่เราทำจะขนาดเล็กหรือใหญ่แน่นอนว่าเครื่องจักรนั้นก็จะต้องใช้มอเตอร์เกียร์เป็นส่วนหนึ่งในการทำงานหรือกลไลระบบในการทำงานอย่างแน่นอน มอเตอร์เกียร์นั้นจะมีโครงสร้างที่สำคัญคือในส่วนของแม่เหล็กถาวรและในส่วนขดลวดตัวนำซึ่งมีโครงสร้างเหมือนเครื่องกำเนิดไฟฟ้า มอเตอร์เกียร์จะทำงานโดยขดลวดเป็นตัวนำทิศทางในการเคลื่อนที่การทำงานของระบบไฟฟ้า ซึ่งเป็นอุปกรณ์ที่โรงงานมักจะนิยมเลือกใช้งานอย่างมากที่สุดเลยทีเดียว ในตอนนี้มอเตอร์เกียร์นั้นจะใช้ในโรงงานอุตสาหกรรม เครื่องจักรกลอุตสาหกรรม เครื่องลำเสียงและอื่น ๆได้อีกด้วย การเลือกใช้มอเตอร์เกียร์นั้นก็ควรที่จะเลือกให้ถูกต้องกับการใช้งานทั้งนี้การเลือกซื้อมอเตอร์เกียร์นั้นก็ต้องเลือกแบบที่สามารถสร้างอัตราทดได้หลากหลายโดยเฉพาะอัตราทดที่สูง ทุก ๆอย่างนั้นเป็นสิ่งที่เราเองควรที่จะให้ความสนใจและให้ความสำคัญอย่างมากที่สุดเพราะว่าการที่เราเลือกสิ่งที่ดีที่สุดให้กับเครื่องจักรอุตสาหกรรมนั้นก็เป็นเรื่องที่ดีที่จะทำให้เรานั้นประสบความสำเร็จได้ ยิ่งเครื่องจักรดีเท่าไหร่ก็ให้ผลงานดีมากเท่านั้นทำให้เราเองไม่ต้องกังวลใจอะไรให้มากมายเลย เพียงแค่ลงทุนซื้อมอเตอร์เกียร์ให้ดีและให้ตรงกับกำลังทดเพียงเท่านี้ก็จะทำให้ทุกอย่างเป็นไปอย่างราบรื่นอีกด้วย สิ่งเหล่านี้จึงเป็นเรื่องที่สำคัญอย่างมากที่สุดเลยที่เราไม่ควรที่จะมองข้ามอะไรที่เราควรที่จะให้ความสนใจหรือลงทุนเพื่อผลตอบรับที่ดีก็ควรที่จะลงทุนเพื่อกำไรที่งามนั้นเอง

ในตอนนี้เกียร์เซอร์โวนั้นเป็นที่รู้จักและเป็นที่นิยมอย่างมากเลยเพราะว่าเกียร์เซอร์โวนั้นสามารถที่จะใช้ในการทำอุตสาหกรรมและโรงงานมากกว่าทำเกี่ยวกับระบบไฟฟ้า ทุกๆอย่างนั้นเป็นเรื่องที่สำคัญและจำเป็นอย่างมากที่สุดที่เราเองไม่ควรที่จะมองข้ามผ่าน การที่เราจะเลือกสิ่งที่ดีที่สุดในการทำอุตสาหกรรมนั้นเราก็จะต้องเลือกสิ่งที่ดีให้กับสินค้าของเราทั้งนั้น เกียร์เซอร์โวในตอนนี้เป็นที่ต้องการของกลุ่มอุตสาหกรรมอย่างมากเลยเพราะว่าเกียร์เซอร์โวจะทำหน้าที่รับคำสั่งจากคอนโทรนเพื่อที่จะส่งต่อไปยังเกียร์เซอร์โว โดยการทำงานของชุดมอเตอร์เซอร์โวในการที่จะทำนี้ก็จะต้องมีชุดคำสั่งลักษณะนี้เสมอ ในบางคนที่ต้องการที่จะใช้เกียร์เซอร์โวอาจจะซื้อหลายตัวก็เลยคิดว่าสิ้นเปลือง แต่ในความเป็นจริงแล้วนั้นการที่เรามีเกียร์เซอร์โวจะทำให้อุตสาหกรรมของเรานั้นทำงานได้รวดเร็วและไวมากยิ่งขึ้นด้วย การทำงานของเกียร์เซอร์โวนั้นจะแปลงค่าพารามิเตอร์ต่างๆที่เราได้ป้อนเอาไว้ทำให้ควบคุมได้ง่ายไม่ยากเลย ในการที่เราให้ความสนใจและความสำคัญในเรื่องของการหาสิ่งที่มาช่วยให้อุตสาหกรรมนั้นลื่นไหลได้เร็วก็จะต้องมีเกียร์เซอร์โวอันนี้แหละมาเป็นสิ่งที่สำคัญในการคลับเคลื่อนให้เครื่องจักรต่างๆได้ทำหน้าที่ได้ทำงานออกมาได้มีประสิทธิภาพมากที่สุด ตัวเกียร์เซอร์โว สามารถที่จะเช็คได้ว่าทำงานเท่าไหร่ ความเร็วเท่าไหร่แล้วเพื่อที่จะได้รับรู้ถึงความแม่นยำและรู้ทันถึงข้อที่ต้องแก้ไขหรือข้อบกพร่องต่างๆได้ เพราะอย่างนี้เกียร์เซอร์โวจึงมีความแม่นยำสูงมากกว่ามอเตอร์ชนิดอื่น เพราะสามารถกำหนดความเร็ว กำหนดแรงบิดทุกอย่างได้ ซึ่งตัวเกียร์เซอร์โว จะช่วยตอบโจทย์ในเรื่องนี้ได้เป็นอย่างดีในตอนนี้ก็มีเกียร์เซอร์โวที่มีขนาดเล็ก ที่ใช้กับงานทั่วไป ไปจนถึงขนาดใหญ่ ที่ใช้กับอุตสาหกรรมขนาดใหญ่ ที่ต้องการกำลังในการขับเคลื่อนที่สูง ซึ่งราคาก็จะขึ้นอยู่กับขนาด ไม่ว่าจะขนาดเล็กหรือใหญ่ก็ควรที่จะใช้ให้ถูกวิธีอีกด้วย ตัวเกียร์เซอร์โวนั้นส่วนมากจะหาซื้อได้ไม่ยากในร้านที่มีจำหน่ายพวกอุปกรณ์เครื่องจักร หรือจะหาจากอินเตอร์เน็ตก็เป็นได้อีกเช่นกัน เรื่องของการทำอุตสาหกรรมนั้นจึงเป็นเรื่องที่หลายๆคนที่ทำธุรกิจควรที่จะใส่ใจให้มากที่สุดเพราะหากเราใช้เกียร์เซอร์โวอย่างดีก็จะทำให้ผลิตงานออกมาได้อย่างมีคุณภาพไม่ทำให้เสียชื่ออีกเช่นกัน ทุกสิ่งทุกอย่างนั้นเป็นเรื่องที่เราเองจะต้องให้ความสนใจอย่างมากที่สุดกับในการหาอุปกรณ์เครื่องจักรอย่างเกียร์เซอร์โวที่คุณภาพยอดเยี่ยมอีกด้วย

Finance

สำหรับการลงทุนอสังหาริมทรัพย์นั้น เชื่อว่าคนส่วนใหญ่คุ้นเคยกับการจำนองหรือนักลงทุนจำนองอย่างดี เพราะการทำสัญญาหรือธุรกิจในลักษณะนี้ ได้รับความนิยมในกลุ่มของนักลงทุนด้านอสังหาริมทรัพย์ ปัจจุบันมีรูปแบบการลงทุนใหม่ ๆ เกิดขึ้นมากมาย หนึ่งในนั้นคือการเป็น นายทุน ขายฝาก ที่ดิน ซึ่งก็จะพามาทำความรู้จักในบทความนี้ นายทุน ขายฝาก ที่ดิน คือ ? นายทุน ขายฝาก ที่ดิน หมายถึง บุคคลที่ต้องการลงทุนในอสังหาริมทรัพย์โดยทำสัญญาซื้อ-ขายกรรมสิทธิ์ในทรัพย์สินระหว่างผู้ฝากขายกับผู้รับซื้อฝาก แต่ผู้รับฝากสามารถมีสิทธิไถ่ถอนทรัพย์สินได้ ผู้รับซื้อฝากต้องให้เงินผู้ฝากขาย ส่วนมากวงเงินจะอยู่ที่ประมาณ 40-60 เปอร์เซ็นต์ เมื่อเทียบกับมูลค่าทรัพย์สินที่จะฝากขาย ธุรกิจฝากขายอสังหาริมทรัพย์ บางกรณี อำนาจต่อรองของผู้ฝากขายน้อยกว่าผู้ซื้อฝาก ทำให้ผู้ขายฝากเสี่ยงต่อการสูญเสียที่ดินทำกินหรือที่อยู่อาศัย ดังนั้น จึงมีกฎหมายคุ้มครองพิเศษที่มากกว่าการทำธุรกิจฝากขายทั่วไป ยกตัวอย่างเช่น ผู้ขายฝากที่เป็นบุคคลธรรมดา มีที่อยู่อาศัยหรือที่ดินเพื่อการเกษตรเป็นทรัพย์สิน ต้องจดทะเบียนกรรมสิทธิ์ในที่ดินและทำเป็นหนังสือ ห้ามมิให้ผู้ซื้อฝากกำหนดราคารับซื้อคืนเกินกว่าราคาขายฝากบวกกับร้อยละสิบห้าต่อปีของราคาขายฝาก เป็นต้น การทำสัญญาขายฝากอสังหาริมทรัพย์ มีเงื่อนไขพิเศษอย่างไร เมื่อมีการทำสัญญาซื้อขายซึ่ง นายทุน ขายฝาก ที่ดิน จะเป็นคนดำเนินการ ผู้ขายฝากก็ยังมีสิทธิใช้ประโยชน์ในทรัพย์สิน ยกตัวอย่างเช่น ประกอบกิจการค้าขาย ทำนาเลี้ยงชีพ ฯลฯ จนกว่าสิทธิไถ่ถอนจะหมด หากเกินกำหนดการไถ่ถอน หรือได้ส่งมอบการครอบครองอสังหาริมทรัพย์ให้ผู้ซื้อฝากแล้ว […]

การสร้างรายได้ผ่านการเทรดเป็นงานที่สามารถทำเงินได้ไม่ว่าจะอยู่ที่ไหน เพียงแค่มีอินเตอร์เน็ตและอุปกรณ์ที่มีโปรแกรมสำหรับการเทรดออนไลน์ เพียงเท่านี้ก็สามารถทำการเทรดได้ง่ายๆแล้ว และในปัจจุบันที่มือถือมีการพัฒนาและคนนิยมใช้งานกันอย่างแพร่หลาย แอปเทรดสำหรับโทรศัพท์มือถือจึงถูกพัฒนาขึ้นและได้รับความนิยมเป็นอย่างมากและรวดเร็ว ซึ่งโบรกเกอร์ที่ต่างกันก็จะมีแอปเทรดสำหรับโทรศัพท์มือถือที่แตกต่างกันออกไป แต่มักจะอยู่บนพื้นฐานที่ใกล้เคียงกัน เพราะโบรกเกอร์เหล่านั้นพัฒนาแอปจากโปรแกรมเดียวกัน การใช้งานแอปเทรดสำหรับโทรศัพท์มือถือจึงไม่ได้มีความแตกต่างกันมากนัก ไม่ว่าจะเป็นขอบเขตการใช้งาน ความสามารถในการวิเคราะห์แลกเปลี่ยน หรือภาษาที่รองรับในการใช้งาน เป็นต้น แอปเทรดสำหรับโทรศัพท์มือถือเป็นอีกตัวช่วยที่มีความสำคัญเป็นอย่างยิ่งสำหรับผู้ที่ต้องการสร้างรายได้ผ่านการลงทุนกับฟอเร็กซ์ ซึ่งแอปเทรดเหล่านั้นสามารถเลือกใช้งานได้โดยอ้างอิงจากโบรกเกอร์ที่น่าเชื่อถือเป็นหลัก หรืออธิบายแบบง่ายๆก็คือ ควรเลือกแอปเทรดของโบรกเกอร์ที่น่าเชื่อถือเพื่อนำมาใช้ในการวิเคราะห์และการตัดสินใจเพื่อลดความเสี่ยงที่จะขาดทุนจากการเทรด รวมถึงเพื่อให้สามารถวางแผนการเทรดได้อย่างมีประสิทธิภาพและทำกำไรจากการเทรดได้มากที่สุด โบรกเกอร์ที่น่าเชื่อถือมักจะมีการพัฒนาแอปเทรดเป็นของตนเอง ดังนั้นในการเลือกแอปเทรดสำหรับโทรศัพท์มือถือจึงสามารถอ้างอิงได้จากบทความ บทวิเคราะห์ รวมไปถึงรีวิวต่างๆของโบรกเกอร์เล่านั้น ซึ่งมักจะมีเว็บไซต์ที่เกี่ยวข้องกับการลงทุนฟอเร็กซ์คอยรวบรวมข้อมูลเหล่านั้นไว้สำหรับผู้ที่สนใจอยู่แล้ว ซึ่งโบรกเกอร์เองก็มีหลายประเภทด้วยเช่นกัน ซึ่งการซื้อขายผ่านโบรกเกอร์แต่ละเจ้าจะแตกต่างกันออกไป รวมไปถึง รายละเอียดในการซื้อขาย ประเภทบัญชี สเปรดที่กำหนด แพลตฟอร์มที่ให้บริการเองก็มีความแตกต่างกันด้วย ซึ่งโบรกเกอร์ส่วนใหญ่จะกำหนดรูปแบบบัญชีและระบุรายละเอียดที่ต้องการไว้อย่างชัดเจน เช่น เงินฝากขั้นต่ำ ประเภทบัญชีซื้อขายจริงที่เปิดกับฟอเร็กซ์ เลเวอเรจสูงสุด มีการระบุช่องทางการชำระเงินที่แตกต่างกันออกไปในแต่ละโบรกเกอร์ เช่น บางเจ้าสามารถชำระเงินผ่านบัตรเครดิตหรือบัญชีธุรกรรมออนไลน์ธนาคารของไทยได้ ในขณะที่บางเจ้าสามารถชำระเงินผ่านวีซ่าการ์ด บัตรเครดิต แต่ไม่สามารถชำระเงินผ่านธุรกรรมออนไลน์ของธนาคารไทยได้ เป็นต้น โบรกเกอร์ฟอเร็กซ์ที่น่าเชื่อถือและได้รับความนิยมในไทยมักจะมีการรองรับภาษาไทยเพื่อให้ง่ายและสะดวกต่อการใช้งาน องค์ที่กำกับดูแลเป็นอีกหนึ่งปัจจัยที่ผู้เลือกโบรกเกอร์ควรพิจารณาอย่างรอบคอบ เพราะโบรกเกอร์ที่น่าเชื่อถือควรได้รับการกำกับดูและและควบคุมโดยองค์กรที่น่าเชื่อถือ โบรกเกอร์บางเจ้ามีองค์องกำกับดูแลมากมายแต่หากองค์กรเหล่านั้นไม่มีความน่าเชื่อถือมากนักก็ไม่ควรเลือกใช้แอปเทรดสำหรับโทรศัพท์มือถือของโบรกเกอร์นั้น การเลือกโบรกเกอร์ที่น่าเชื่อถือมีผลโดยตรงต่อการตัดสินใจเลือกแอปเทรดสำหรับโทรศัพท์มือถือ เพราะความเกี่ยวเนื่องส่งผลต่อกันอย่างมีนัยยะสำคัญ โดยโบรกเกอร์สามารถเลือกได้โดยพิจารณาคุณสมบัติต่อไปนี้ หน่วยงานกำกับดูแลและใบอนุญาต ค่าคอมมิชชั่นและสเปรด […]

การเปลี่ยนแปลงในตลาดของฟอเร็กซ์ เป็นสิ่งที่เทรดเดอร์ทุกคนต้องรับรู้และเตรียมพร้อมที่จะรับความเสี่ยงเหล่านั้นให้ได้ เพราะอย่างที่ทราบกันดีว่าตลาดของฟอเร็กซ์นั้นมีการเปลี่ยนแปลงทุกนาที นั่นหมายความว่าความเสี่ยงเกิดขึ้นได้ตลอดเวลา เราอาจจะได้กำไรหรือขาดทุนได้ เพียงแค่ระยะไม่นาน ดังนั้นการเตรีมความพร้อมเพื่อที่จะรับความเสี่ยงก็คือการติดตามความเคลื่อนไหวของ ปฏิทินforex นั่นเอง โดยปฏิทินของฟอเร็กซ์นั้นจะเป็นตัว กำหนดและตัดสินใจของเทรดเดอร์ว่าควรจะเลือกลงทุนแบบไหนดี ให้มีความเสี่ยงน้อยที่สุด และเทรดเดอร์ทุกคนก็ควรจะรู้จักวิธีการใช้งาน วิธีอ่านข่าวในปฏิทินให้ลำนาญเสียก่อน ไม่เช่นนั้นอาจจะขาดทุนได้ง่ายๆ ก่อนอื่นลองมาดูว่ามีปัจจัยอะไรบ้างเกี่ยวกับข่าวสารในปฏิทินฟอเร็กซ์ ที่สามารถสร้างผลกระทบกับสกุลเงินต่างๆ ในฟอเร็กซ์ได้มากที่สุด 1.สภาพเศรษฐกิจ เป็นตัวแปรสำคัญที่ทำให้เกิดการเปลี่ยนของค่าเงินได้มากที่สุด แม้แต่ตลาดการแลกเปลี่ยนสกุลเงินอย่างฟอเร็กซ์ก็จะได้รับผลกระทับเช่นกัน โดยเฉพาะประเทศที่มีสภาพเศรษฐกิจใหญ่ระดับโลกอย่างอเมริกา หากมีการเปลี่ยนแปลงของ ปฏิทินforex ทางเศรษฐกิจ ระบบต่างๆ ทั่วโลกก็จะได้รับผลกระทบไปด้วยอย่างหลีกเลี่ยงไม่ได้ 2.สถานการณ์ทางการเมือง เหตุการณ์ทางการเมืองก็เป็นอีกหนึ่งตัวแปรที่สำคัญเช่นกัน หากประเทศนั้นมีสภาพทางการเมืองที่ไม่อำนวยต่อการลงทุน และมีผลกระทบต่อเศรษฐกิจ ก็จะทำให้ตลาดการแลกเปลี่ยนสกุลเงินได้รับผลกระทบไปด้วยเช่นกัน ดังนั้นนักลงทุนหรือเทรดเดอร์จะสังเกตการเปลี่ยนแปลงของประเทศคู่ของสกุลเงินอยู่ตลอดเวลา เพื่อดูว่าสถานการณ์ทางการเมืองจะปรกติเมื่อไหร่ เพราะถ้าหากตัดสินใจผิดพลาดในขณะทีประเทศนั้นมีปัญหาทางการเมืองอยู่ ก็มีความเสี่ยงที่จะขาดทุนได้ 3.การเติบโตของ GDP GDP เป็นตัวชี้วัดคุณภาพของเศรษฐกิจของประเทศนั้น ซึ่ง ปฏิทินforex จะมีรายละเอียดของประเทศที่มีการเติบโตหรือว่าลดของ GDP ด้วยเพื่อนักลงทุนจะได้ตัดสินใจซื้อขายหรือลงทุนได้อย่างรอบคอบยิ่งขึ้น หากประเทศคู่ของสกุลเงินใดที่มีอัตราการเติบโตของ GDP ลดลง ก็มีแนวโน้มว่าค่าเงินในตลาดการแลกเปลี่ยนสกุลเงิน ก็จะได้รับผลกระทบไปด้วย จะเห็นว่าข้อมูลเหล่านี้ล้วนสำคัญกับเทรดเดอร์อย่างยิ่ง และไม่สามารถมองข้ามได้ เพราะอาจจะเสี่ยงที่จะทำให้เกิดการลงทุนที่ผิดพลาดนั่นเอง ดังนั้น ปฏิทินforex […]

พื้นฐานของคนที่ร่ำรวยแทบทุกคน ล้วนมาจากการประหยัด และการรู้จักเก็บเงินทั้งนั้น ไม่มีคนไหนที่รวย จากการใช้เงินอย่างฟุ่มเฟือยแน่นอน การฝึกนิสัย ให้เป็นคนที่รู้จักอดออม ประหยัด จึงเป็นสิ่งสำคัญ ที่จะช่วยให้เราสำเร็จในชีวิตมากยิ่งขึ้น แม้จะเป็นเงินจำนวนเล็กน้อยก็ตาม หากเรารู้จักเก็บ สักวันมันก็ต้องเป็นจำนวนเงินที่มาก อยู่ดี อย่าไปดูถูกว่า เก็บเท่านี้เมื่อไหร่มันจะรวย เรามาดูเหตุผลกันหน่อยว่า เพราะอะไร เราถึงต้องมีเงินเก็บ เงินสำรองเอาไว้ และถ้าเราไม่มีเงินพวกนี้เอาไว้เลย ชีวิตของเรา จะเป็นอย่างไร มีเงินใช้เวลาที่ชีวิตสะดุด เราไม่รู้เลยว่า ชีวิตวันต่อไปเราจะต้องเจอกับอะไรบ้าง จะมีเหตุการณ์อะไร ที่จะทำให้เราต้องเสียเงินหรือเปล่า อย่างเช่นการเจ็บป่วย หรือค่าใช้จ่ายต่างๆ ที่มาโดยที่ไม่คาดคิดมาก่อน หรือแม้จะเป็นการตกงาน การถูกเลิกจ้าง เป็นต้น หากเราไม่มีเงินสำรองเอาไว้เลย เมื่อเจอกับเหตุกรณ์พวกนี้ มันจะทำให้เรารู้สึกเคว้งคว้างมาก ไม่รู้ว่าจะไปหาเงินที่ไหนมาใช้ ยิ่งเวลาตกงาน กว่าจะหางานทำใหม่ได้ ไม่ใช่เรื่องง่ายเลย เงินสำรอง จึงเป็นความจำเป็นอย่างยิ่ง สำหรับเหตุการณ์พวกนี้ ไม่มีกังวล เมื่อเรามีเงินที่สำรองเอาไว้ เราก็จะทำอะไรได้ปลอดภัยมากขึ้น เช่นการเอาเงินบางส่วนไปลงทุน หรือพวกเรื่องค่าใช้จ่ายต่างๆ เช่นการผ่อนบ้าน ผ่อนรถ เราก็จะได้ไม่เกิดความกังวล หากบางครั้งเงินที่ใช้จ่ายทุกวันมันไม่เหลือ เราก็สามารถเอาเงินส่วนนี้ออกมาใช้จ่ายแทนได้ เป็นความปลอดภัยของชีวิตของเราด้วย […]

การออมเงินการเก็บเงิน เป็นสิ่งที่สำคัญมาก ในการใช้ชีวิตของคนเรา และการรู้จักเก็บออมเงิน มันเป็นพื้นฐานของคนที่อยากจะรวย และเป็นนิสัยของคนรวยเลยก็ว่าได้ เพราะคนที่ร่ำรวย มั่งคั่ง ล้วนมีพื้นฐานจากการเก็บเงินแทบทุกคน ยิ่งในยุคที่ข้าวยากหมากแพงอย่างทุกวันนี้ ทำงานอะไรก็ยาก เงินก็น้อย การเก็บเงิน จึงเป็นสิ่งที่จำเป็นมากที่สุด เพื่อที่จะได้มีเงินเอาไว้ใช้ในยามฉุกเฉิน แต่ปัญหามันก็อยู่ที่ บางคนไม่สามารถเก็บได้ อาจจะทำไปสักเดือนสองเดือน หรือน้อยที่สุดทำไปได้แค่อาทิตย์เดียว ก็ต้องงัดกระปุกออกมาอีกแล้ว หรือไม่ก็ถอนออกมาใช้หมดเสียแล้ว ปัญหาพวกนี้ จะต้องแก้อย่างไรดี ให้เราสามารถเก็บเงินได้โดยที่ไม่ต้องเอาออกมาใช้ก่อนเวลาอันควร 1.เลือกกระปุกออมสินที่มันแคะยากๆ คนที่เก็บเงินด้วยการหยุดกระปุก หากไม่สามารถควบคุมตัวเอง ในการเก็บเงินได้ ก็ควรเลือกหากระปุกออมสิน ที่มันแข็งแรง ยากต่อการทุบเอามาไว้สำหรับหยอดเงิน เวลาที่เราอยากจะเอาออกมาใช้ มันจะได้ยากมากขึ้น จนทำให้มันไม่อยากเอาออกมาใช้ อาจจะใช้เป็นเหล็กหนาๆ ก็ได้จะได้ทุบยากหน่อย วิธีนี้เหมาะมาก สำหรับคนที่ชอบแงะกระปุกออมสิน 2.ไม่ต้องทำบัตร ATM คนที่เน้นการเก็บเงินในบัญชีธนาคาร หากไปเปิดบัญชีมาแล้ว ก็ไม่ควรจะเอาบัตรกดเงินสดมาด้วย เพราะถ้ามีบัตรกดมาด้วยเมื่อไหร่ ยังไงเราก็ไม่มีวันเก็บเงินได้แน่นอน ยังไงก็ต้องเอาออกมาใช้ เอาแค่สมุดอย่างเดียวพอ เวลาถอนมันจะได้ลำบากหน่อย เพราะต้องเอาสมุดไปเบิกเงิน ที่ธนาคารอย่าเดียวเท่านั้น ยิ่งถ้าธนาคารอยู่ไกล เราก็ไม่อยากจะได้เงินแล้ว 3.หักเงินที่ต้องเก็บออกก่อนเสมอ เวลาที่ได้เงินเดือนมา สิ่งแรกที่ต้องทำเลยก็คือ […]

Work

สำหรับคนที่ตกงานและว่างงานอยู่แน่นอนว่าการหางานทำนั้นคงเป็น Point หลัก ๆ เลยก็ว่าได้ สำหรับคนที่กำลังมองหางานอยู่นั้นวันนี้ในบทความนี้เรามีคำแนะสำหรับการเตรียมตัวเมื่อเจอ “ประกาศ รับสมัครพนักงาน ” เราควรจะเริ่มอย่างไรมีโอกาสในการได้ไปสัมภาษณ์งานมากขึ้น เช็คเอกสาร ว่าพร้อม และเป็นปัจจุบันหรือไม่ ? อย่างแรกเลยนั้นคือการเตรียมตัวในเรื่องเอกสาร ทั้งออนไลน์ และ การสมัครหน้างาน ว่าเราเตรียมเอกสารพร้อมหรือไม่ไม่ว่าจะเป็นสำเนาต่าง ๆ ที่ใช้ในการสมัครงานเช่น สำเนาวุฒิการศึกษา สำเนาบัตรประชาชน ซึ่งการเตรียมเอกสารไว้ก่อนจะช่วยให้เราเตรียมความพร้อมได้มากขึ้น นอกจากนี้ในการสมัครออนไลน์ ก็ควรจะเตรียม Resume ให้พร้อมหากมีการเปลี่ยนแปลงด้วยเช่นกัน ดูวันที่รับสมัคร และส่งเอกสาร การส่งเอกสารหน้างานนั้นอาจะไม่ใช่เรื่องยากมากนัก แต่ถ้าหากเป็นการส่ง E-mail ละก็เราควรจะศึกษาวิธีการส่ง E-mail ในการสมัครงานได้เลยนะครับ เพราะว่าการรับส่ง E-mail นั้นก็มีจุดที่สมควรทำและไม่สมควรทำด้วยเช่นกัน เช่นการเกริ่น E-mail การตั้งชื่อหัวข้อในการส่ง และเรื่องอื่น ๆ ด้วยเช่นกัน เพราะถ้าหากเราส่งผิด หรือ ส่งไปแบบส่ง ๆ ทาง HR ก็จะกดลบ […]

หลาย ๆ คนที่เริ่มสมัครงาน และ เริ่มหางานเมื่อหลังจากที่ผ่านช่วงสัมภาษณ์ได้ต่อมาก็อาจจะเจอกับการตรวจสุขภาพ ซึ่งหลาย ๆ คนอว่าการตรวจสุขภาพนั้นจำเป็นต่อการเข้าทำงานหรือไม่ ? ทั้ง ๆ ที่กฎหมายก็ไม่มีข้อไหนบังคับให้ตรวจสุขภาพก่อนเริ่มงาน ดังนั้นวันนี้เราจะมาไขข้อข้องใจกันว่า “ทำไมเราถึงต้องตรวจสุขภาพก่อนเริ่มงาน” ทำไมจึงต้องตรวจสุขภาพก่อนเริ่มงาน ก่อนอื่นเราต้องทำความเข้าใจก่อนว่า ตรวจสุขภาพก่อนเริ่มงานั้นจะมีข้องบังคับตามกฎหมาย เฉพาะอาชีพที่มีความเสี่ยงต่อสารเคมีเท่านั้น และ อาชีพที่ต้องอยู่ในสภาพแวดล้อมเสี่ยงอันตรายตลอดเวลา หรือ สภาพอากาศเลวร้ายตลอดเวลาเท่านั้น ดังนั้นสำหรับอาชีพที่ไม่มีความเสี่ยงจึงไม่ต้องตรวจสุขภาพก็ได้ เเต่นั้นก็หมายว่าตัวคุณอาจจะไม่ได้งานด้วยก็ได้ เพราะเนื่องจากการตรวจสุขภาพก่อนเริ่มทำงานนั้นเป็นนโยบายบริษัทก่อนจะรับคนเข้าทำงานนั้นเอง ตรวจสุขภาพก่อนเริ่มงานตรวจอะไรบ้าง ? การตรวจสุขภาพก่อนเริ่มงานนั้นจะเป็นการตรวจสุขภาพเบื้องต้น อาทิเช่น ความดัน ออกซิเจน น้ำหนัก และ ส่วนสูง เป็นต้น หลังจากนั้นในเเต่ละบริษัทก็จะให้ตรวจเฉพาะจุดที่แตกต่างกันไปเช่น ตรวจตาบอดสี ตรวจเอ็กซเรย์ปอด และยังมีการตรวจ ในเรื่องของสารเสพติดจากปัสวะ เพื่อยืนยันว่าเรานั้นไม่ใช่คนที่ติดสารเสพติดและมีสุขภาพพร้อมทำงานจริง ๆ ตรวจสุขภาพได้ที่ไหน สำหรับคำถามที่ว่าเราจะสามารถตรวจสุขภาพที่ไหนนั้น เราสามารถสอบถามกับทางบริษัทได้เลยเพราะว่าบางบริษัทก็สามารถตรวจสุขภาพได้อานามัยใกล้บ้าน หรือ บางที่อาจจะต้องตรวจกับคลินิกตรวจสุขภาพก่อนเข้าทำงาน หรือ สถาณพยาบาล ดังนั้นควรถามให้แน่ใจก่อนว่าสามารถคลินิกตรวจสุขภาพก่อนเข้าทำงาน หรือ […]

5G คือเทคโนโลยีเครือข่ายของการสื่อสารแบบไร้สายในยุคที่ 5 ต่อมาจากยุค 1G และ 2G ที่ยังคงเป็นระบบอะนาล็อกมาจนถึงยุค 3G และ 4G ที่เข้าสู่ยุคของเทคโนโลยีระบบดิจิตอล ซึ่งไม่เพียงแต่เรื่องของความเร็วของการส่งผ่านข้อมูลที่จะมีความเร็วมากกว่าระบบ 4G เท่านั้น แต่ 5G จะเป็นยุคของการเชื่อมต่อและการสื่อสารแบบไร้สายและไร้พรมแดนอย่างแท้จริง ความเร็วและเทคโนโลยีที่เหนือกว่าของระบบ 5G มาดูเรื่องของความเร็วเมื่อเปรียบเทียบกับเทคโนโลยี 4G ที่ถือเป็นการส่งผ่านข้อมูลที่มีความเร็วสูงสุดในปัจจุบัน พบว่าตามทฤษฎีแล้วนั้น เทคโนโลยี 4G สามารถใช้งานได้ที่ความเร็วสูงสุด 100 เมกะบิตต่อวินาที แต่ 5G จะมีความเร็วกว่าระบบ 4G เดิมถึง 10 เท่า นั่นหมายความว่าคุณจะสามารถดาวน์โหลดหนังที่มีความยาว 2 ชั่วโมงได้ในระยะเวลาเพียง 3.6 วินาทีเท่านั้น! 5G กับสิ่งที่เรียกว่า Internet of Things (IoT) ในยุค 5G นั้น ไม่เพียงแต่อุปกรณ์อิเล็กทรอนิกส์อย่างสมาร์ตโฟนเท่านั้นที่จะสามารถรับและส่งต่อข้อมูลถึงกันได้ แต่จะรวมไปถึงอุปกรณ์อิเล็กทรอนิกส์อื่น ๆ […]

Lifestyle

หากว่ากันด้วยเรื่องของสิ่งที่เล็กและมองเห็นได้ยาก จะสัมผัสได้ก็ต่อเมื่อเกิดการสะสมเป็นเวลานานๆ แถมยังเป็นสาเหตุของการเกิดโรคทางเดินหายใจได้อีก ซึ่งสิ่งที่เราจะกล่าวถึงในวันนี้นั้นก็คือ “ฝุ่น” นั้นเองครับ บทคามนี้จะขอพาทุกๆ ท่านไปพบกับ “สาเหตุของการเกิดฝุ่น” พร้อมกับทำความเข้าใจเกี่ยวกับฝุ่นแบบเบื้องต้นกันครับ จะเป็นอย่างไรกันบ้างนั้น….เราไปชมกันดีกว่าครับผม

ว่ากันด้วยวิธีการทำความสะอาดบ้านในทุกๆ วันของเรานั้น เหล่าบรรดาพ่อบ้านแม่บ้านทั้งหลายต่างก็ต้องใช้ทั้งแรงกายแรงใจในการทำความสะอาดห้องหรือบ้านกันอยากหนักเลยก็ว่าได้ครับ จะดีกว่ามั้ยถ้าเราสามารถหย่นเวลาในการทำความสะอาด เช็ดถูพวกฝุ่นผงต่างๆ ได้ วันนี้เราอยากมาแนะนำเกี่ยวกับ “เครื่องดูดฝุ่น” พร้อมกับแนะนำวิธีเลือกเครืองดูดฝุ่นให้เหมาะกับห้องหรือบ้านกันครับ จะเป็นอย่างไรบ้างนั้น…เราไปชมกันดีกว่าครับผม

หากว่ากันด้วยเรื่องของเครื่องมือช่างต่างๆ นั้น ย่อมพกไว้ไปไหนก็คงจะมีประโยชน์มากกว่าที่ทิ้งเอาไว้ภายในบ้านกันใช่มั้ยหล่ะครับ และยิ่งเป็นรถยนต์ของเราแล้วนั้น การเดินทางไปไหนมาไหนบ่อยๆ ก็ย่อมที่มักที่จะเกิดเหตุไม่คาดฝันต่างๆ เกิดขึ้นกับเราและตัวรถได้เช่นกัน จะดีกว่ามั้ยถ้าเรามีตัวช่วยหรือเครื่องมือช่างติดรถกันเอาไว้สักหน่อย วันนี้เราเลยอยากจะพาทุกๆ ท่านไปพบกับ “6 เครื่องมือช่างที่ต้องมีติดรถยนต์” กันครับ จะมีอุปกรณ์ใดกันบ้างนั้น…เราไปชมกันดีกว่าครับ

ปัญหาหรืออันตรายที่เกี่ยวกับเรื่องของไฟฟ้าลัดวงจรนั้นไม่ใช่สิ่งที่ไกลตัวเราอย่างที่คิดนะครับ หากประมาทเพียงชั่วครู่ก็อาจทำให้ถึงแก่ชีวิตได้เลยเช่นกันครับ วันนี้เราเลยอยากพาทุกๆ ท่านไปพบกับ “4 วิธีการเช็คว่ามีไฟฟ้าลัดวงจรหรือไม่?” ที่ทุกๆ ท่านสามารถนำไปใช้กันได้ครับ จะเป็นอย่างไรกันบ้างนั้น…เราไปชมกันดีกว่าครับผม

หลายๆ ท่านทราบกันหรือไม่ครับว่าหนึ่งในสิ่งที่สำคัญที่สุดสำหรับการเช็คบ้านนั้น ก็คือเรื่องของการเดินสายไฟต่างๆ ซึ่งไม่แพ้เรื่องของโครงสร้างของตัวห้องหรือบ้านเลยหล่ะครับ วันนี้เราจะพาทุกๆ ท่านไปหาความรู้เกี่ยวกับ “หลักการเดินสายไฟ” และ “การเดินสายไฟที่ดีของช่างเป็นแบบไหน” กันครับ เพื่อเป็นการไม่เสียเวลา เราไปชมกันดีกว่าครับผม

ว่ากันด้วยเรื่องของความสะอาดบ้านนั้น เป็นสิ่งที่ต้องใช้พลังและแรงกายในการทำเป็นอย่างมาก จนเรียกได้ว่า “ดูเหมือนง่าย แต่ทำอ่ะโคตรดหนื่อย” ซึ่งต้องยอมใจเหล่าบรรดาพ่อบ้านแม่ศรีเรือนกันเลยก็ว่าได้ครับ ซึ่งอาวุธหลักหรืออุปกรณ์ในการทำความสะอาดบ้านนั้นมีมากมายหลายแบบ และหนึ่งในอุปกรณ์ที่ใช้งานกันทุกบ้านนั้นก็คือ “ไม้ถูพื้น” บทความนี้เราจึงอยากพาทุกๆ ท่านไปทำความรู้จักกันครับ จะเป็นอย่างไรบ้างนั้น…เราไปชมกันเล้ยย!! นิยามของไม้ถูพื้น ไม้ถูพื้น หรือ ไม้ Mop เป็นอุปกรณ์ที่ใช้สำหรับเช็ดถูทำความสะอาดคราบสิ่งสกปรกและฝุ่นละอองต่างๆ บนพื้นได้อย่างรวดเร็วและสะอาดหมดจด โดยทั่วไปไม้ถูพื้นจะมีให้เลือกใช้งานทั้งใช้ทำความสะอาดพื้นแห้งและพื้นเปียกได้ ใช้งานง่ายด้วยโครงสร้างที่มีด้ามจับยาวทำจากสแตนเลสหรือพลาสติกที่แข็งแรงทนทาน จับกระชับมือ ไม่เป็นสนิม และส่วนหัวไม้ถูพื้นที่ใช้เช็ดถูทำความสะอาดพื้นจะทำจากผ้าหรือแผ่นฟองน้ำที่มีคุณสมบัติดูดซับน้ำ ดักฝุ่นได้ดีเยี่ยม เรียกได้ว่าทุกๆ บ้านทุกๆ ห้องต้องมีติดบ้านอย่างแน่นอนครับ 4 ประเภทไม้ถูพื้นที่ควรมีติดบ้าน ●ไม้ถูพื้นแบบแกนสกรู ไม้ถูพื้นแบบแกนสกรูนั้นจะมีลักษณะคล้ายกับไม้ถูพื้นแบบหนีบ แต่จะแตกต่างกันด้วยวิธีการยึดผ้าถูพื้นกับด้ามจับ ซึ่งไม้ถูพื้นแบบแกนสกรูนั้นจะเป็นการใช้สกรูตัวยาวยึดผ้าถูพื้นกับด้ามจับนั่นเอง ซึ่งจุดเด่นของไม้ถูพื้นแบบนี้คือมีความทนทาน ใช้ทำความสะอาดในซอกมุมต่างๆ และพื้นที่แคบได้ดี ●ไม้ถูพื้นแบบดันฝุ่น เป็นไม้ถูพื้นที่ค่อนได้รับความนิยมมากขึ้นในปัจจุบัน เพราะสามารถถูพื้นพร้อมเช็ดฝุ่นไปได้เลยในเวลาเดียวกัน ทำให้ประหยัดเวลาทำความสะอาดบ้านไปได้มากพอสมควร เนื่องจากไม่ต้องกวาดบ้านก่อนที่จะทำการถูพื้นนั่นเอง ไม้ถูพื้นแบบดันฝุ่นนั้นจะใช้คู่กับน้ำยาถูพื้น หรือน้ำยาดันฝุ่น จึงจะได้ผลดีที่สุด จุดเด่นของไม้ถูพื้นประเภทนี้คือสามารถซึมซับน้ำได้มาก เก็บกักฝุ่นได้ดี เหมาะสำหรับพื้นที่ซึ่งมีฝุ่นเยอะ ●ไม้ถูพื้นแบบฟองน้ำ ไม้ถูพื้นแบบฟองน้ำเป็นไม้ถูพื้นที่มีหัวเป็นฟองน้ำ เหมาะสำหรับการซับน้ำมากที่สุด เนื่องจากหัวฟองน้ำสามารถซับน้ำได้เป็นจำนวนมาก และยังสามารถรีดน้ำออกได้ด้วยตัวเอง เนื่องจากมีการติดตั้งตัวรีดน้ำไว้บริเวณหัวของไม้ถูพื้นนั่นเอง ●ไม้ถูพื้นแบบรีดน้ำ […]

ในการทำความสะอาดบ้าน หลายๆ ท่านก็คงจะมีอุปกรณ์คู่ใจและเป็นสิ่งที่เรียกได้ว่า “ของมันต้องมี!!” กันบ้างใช่มั้ยหล่ะครับ ซึ่งสำหรับว่าวันนี้เราจะขอพาทุกๆ ท่านไปพบกับ “ไม้ถูพื้นแบบต่างๆ ” ที่มีมากมายหลายแบบที่คุณอาจจะไม่ทราบว่า เอ้ยย มีไม้ถูพื้นแบบนี้ด้วยเหรอกันครับ จะเป็นอย่างไรกันบ้างนั้น…เราไปชมกันดีกว่าครับ ไม้ถูพื้นประเภทต่างๆ ที่น่าสนใจ ●ไม้ม็อบดันฝุ่น การทำงานของไม้ม็อบดันฝุ่นเปรียบได้กับเครื่องดูดฝุ่น เพราะเมื่อถูพื้นในบริเวณที่มีฝุ่น ผ้าม็อบจะกักเก็บฝุ่นไว้ โดยไม่ต้องใช้น้ำและไม่ทำให้ฝุ่นฟุ้งกระจาย ซึ่งไม้ม็อบดันฝุ่นจะมีประสิทธิภาพมากเมื่อใช้ในบริเวณที่แห้ง และจะมีประสิทธิภาพดีขึ้นเมื่อใช้ร่วมกับน้ำยาดันฝุ่น เป็นไม้ม็อบแบบที่เหมาะกับการใช้งานในที่กว้าง ●ไม้แบบหัวบิดผ้า ไม้ม็อบที่มีหัวบิดผ้าในตัว ช่วยให้คุณบีบน้ำออกจากผ้าให้พอหมาดหรือให้แห้งได้สะดวกและง่ายดาย โดยที่ไม่ต้องกังวลว่าเศษฝุ่นหรือสิ่งสกปรกจะมาเลอะมือ และไม่เปลืองแรงในการบีบน้ำออกจากผ้า ช่วยให้การทำความสะอาดบ้านไม่เป็นเรื่องน่าเบื่อหน่าย ●ไม้พร้อมถังปั่น ไม้ม็อบที่มาพร้อมถังปั่น เป็นไม้ม็อบอีกชนิดที่ไม่ต้องใช้มือบิดผ้า ไม่ต้องก้ม ๆ เงย ๆ หรือวุ่นวายกับการซักผ้าถูพื้นซ้ำ ๆ โดยผ้าที่หัวไม้ม็อบส่วนมากแล้วจะทำจากไมโครไฟเบอร์ จึงสามารถดูดซับน้ำ และจับสิ่งสกปรกได้เป็นอย่างดี เหมาะกับการถูทำความสะอาดได้ทุกพื้นผิว และหัวไม้ม็อบเป็นรูปทรงกลม หมุนได้ 360 องศา ทำให้สามารถถูได้ง่าย ทำความสะอาดได้กว้างและทั่วถึงทุกซอกทุกมุม ส่วนถังใส่น้ำจะมีทั้งส่วนที่สามารถจุ่มน้ำยาถูพื้นและใช้ทำความสะอาดไม้ถู ●ไม้แบบฟองน้ำ ไม้ม็อบแบบฟองน้ำสามารถกำจัดได้ทั้งคราบน้ำ คราบสกปรก หรือบริเวณที่น้ำท่วมขังให้แห้งไว ไม่ทิ้งคราบสกปรกไว้บนพื้นผิว ทำให้คุณประหยัดเวลา […]

เคยรู้จักเหนื่อยและเบื่อทุกครั้งที่จะต้องทำความสะอาดกันมั้ยครับ เพราะการจะลงมือทำความสะอาด ปัดกวาด เช็ดถูหรือดูดฝุ่นทุกๆ ครั้งต้องอาศัยพลังงานทั้งแรงกาย แรงมากมายอย่างน่าฉงนมากเลยหล่ะครับ ดูเหมือนว่าจะง่ายนะครับ แตจริงๆ แล้วจะทำให้สะอาดเลยมันยากเอาเรื่องเลยหล่ะครับ ซึ่งเดี๋ยวนี้เทคโนโลยีในการทำความสะอาดมีมากมาย วันนี้เราจึงอยากพาทุกๆ ท่านไปพบกับ “ทำไมต้องซื้อเครื่องดูดฝุ่นอเนกประสงค์” กันครับ จะเป็นอย่างไรบ้างนั้น…เราไปชมกันเล้ยย!!! เครื่องดูดฝุ่นคืออะไร? เครื่องดูดฝุ่น มีมอเตอร์ ในการทำงานของเครื่องดูดฝุ่น – ดูดน้ำ เนื่องจากมอเตอร์ดูดฝุ่น – ดูดน้ำ ถูกออกแบบมาเพื่องานทำความสะอาดหนัก ๆ ที่ต้องใช้แรงดูดสูง สามารถทำความสะอาดได้ทั้งแบบแห้ง และแบบเปียก ดูดได้ทั้งฝุ่นผง เศษขยะ และของเหลวอย่างน้ำ เช่น น้ำจากการทำความสะอาด โดยมีหลักการทำงานของมอเตอร์เครื่องดูดฝุ่น wet/Dry มีดังนี้ – แรงดูดจากมอเตอร์สุญญากาศ จะนำพาฝุ่นผง สิ่งสกปรก และอากาศ จากปลายของสายดูดฝุ่น เข้ามาที่ตัวถังอย่างรวดเร็ว – ฝุ่นและน้ำจะถูกกรอง และกักเก็บอยู่ภายในตัวถัง– ส่วนลม และอากาศจะถูกดูดขึ้นมาโดยใบพัดบริเวณฐานของมอเตอร์ และจะระบายออกทางช่องระบายอากาศ ด้านบนของเครื่องดูดฝุ่น ทำความรู้จักกับ เครื่องดูดฝุ่นที่ดูดน้ำก็ได้ฝุ่นธรรมดาก็แจ่ม หัวใจสำคัญของเครื่องดูดฝุ่น-ดูดน้ำ คือ […]

บทความนี้เราจะมาพูดถึงเช็คลิสต์ทำธุรกิจการนำเข้าของจากจีนอย่างไรให้ปังไม่มีแป้กกัน สำหรับนักธุรกิจมือใหม่ต้องห้ามพลาดเลยทีเดียวเชียว ดังนั้น อย่ามัวเสียเวลาเราไปดูกันเลยดีกว่าว่าเช็คลิสต์ทำธุรกิจการนำเข้าของจากจีนอย่างไรให้ปังไม่มีแป้กนั้นมีอะไรที่น่าสนใจกันบ้าง รวมเช็คลิสต์ทำธุรกิจการนำเข้าของจากจีนอย่างไรให้ปังไม่มีแป้ก และเช็คลิสต์ทำธุรกิจการนำเข้าของจากจีนอย่างไรให้ปังไม่มีแป้ก ข้อสุดท้าย คือ ขอรับใบอนุญาตและสัญญาประกอบธุรกิจ เอกสารประกอบธุรกิจ เป็นหนึ่งในกระบวนการเริ่มต้นธุรกิจของคุณเอง มีใบอนุญาตประกอบธุรกิจขนาดเล็กมีหลายประเภท และใบอนุญาตแต่ละประเภทขึ้นอยู่กับลักษณะของธุรกิจของคุณ คุณจะต้องศึกษาว่าใบอนุญาตประกอบกิจการใดบ้างที่ทำไปใช้ในการเริ่มต้นธุรกิจของคุณ เพราะหากคุณไม่ทำ นั่นจะเท่ากับว่าคุณทำธุรกิจผิดกฎหมายเลยทีเดียวเชียวล่ะ

สิ่งต่างๆ ย่อมมีคู่ มีความเหมาะสมซึ่งกันและกันเกือบทั้งนั้น ไม่เว้นแม้แต่อุปกรณ์ทำความสะอาดอย่างไม้ถูพื้นก็ต้องมีแบบที่เหมาะกับพื้นแต่ละแบบเช่นกัน วันนี้เราจะขอพาทุกๆ ท่านไปสำรวจและค้นคว้าดูกันว่า…”จะเลือกไม้ถูพื้นอย่างไรให้เหมาะกับพื้นแบบต่างๆ” ต้องทำอย่างไร ดูอย่างไร กัน วันนี้เราจะหาคำตอบกันครับ แต่ก่อนอื่นเราไปดูกันก่อนดีกว่าว่า ไม้ถูพื้นเป็นอย่างไรกันครับ ไม้ถูพื้นอุปกรณ์พื้นๆ ที่ประโยชน์มากมาย ไม้ถูพื้น คือ อุปกรณ์ที่ใช้สำหรับเช็ดถูทำความสะอาดคราบสิ่งสกปรกและฝุ่นละอองต่างๆ บนพื้นได้อย่างรวดเร็วและสะอาดหมดจด โดยทั่วไปไม้ถูพื้นจะมีให้เลือกใช้งานทั้งใช้ทำความสะอาดพื้นแห้งและพื้นเปียกได้ ใช้งานง่ายด้วยโครงสร้างที่มีด้ามจับยาวทำจากสแตนเลสหรือพลาสติกที่แข็งแรงทนทาน จับกระชับมือ ไม่เป็นสนิม และส่วนหัวไม้ถูพื้นที่ใช้เช็ดถูทำความสะอาดพื้นจะทำจากผ้าหรือแผ่นฟองน้ำที่มีคุณสมบัติดูดซับน้ำ ซึ่งเราสามารถยกตัวอย่างประเภทของไม้ถูพื้นได้ดังต่อไปนี้ ●ไม้ถูพื้นแบบซับน้ำ เป็นไม้ถูพื้นที่บริเวณส่วนหัวจะใช้ผ้าโพลีเอสเตอร์ถักทอพิเศษในการเช็ดถูทำความสะอาดพื้นเปียก ซึ่งจะมีคุณสมบัติดูดซับน้ำและสิ่งสกปรกได้ดีเยี่ยม สามารถถอดออกมาซักด้วยเครื่องซักผ้าหรือซักมือก็ได้ เมื่อแห้งนำผ้ามาหนีบเข้ากับหัวไม้ถูพื้นอีกครั้ง จึงเหมาะสำหรับงานทำความสะอาดพื้นทั่วไป เช่น พื้นในห้องครัว พื้นโรงงาน พื้นห้องคลีนรูม เป็นต้น ●ไม้ถูพื้นแบบซับสารเคมี เป็นไม้ถูพื้นที่มีโครงสร้างของส่วนหัวไม้ถูพื้นทำมาจากผ้าโทนสีน้ำตาลชนิดพิเศษที่มีคุณสมบัติช่วยดูดซับส่วนผสมของน้ำมัน สารเคมีได้ดีเยี่ยม และยังสามารถดักจับฝุ่นด้วยไฟฟ้าสถิตและขัดเงาได้ในครั้งเดียว โดยสามารถใช้งานได้ทั้งพื้นแห้งและพื้นเปียก ซึ่งเหมาะสำหรับทำความสะอาดพื้นที่เฉพาะเจาะจงหรือพื้นที่ปลอดเชื้อ เช่น สำนักงาน, โรงงานอุตสาหกรรม, ร้านค้า, ห้องคลีนรูม เป็นต้น ●ไม้ถูพื้นแบบกำจัดฝุ่น เป็นไม้ถูพื้นอเนกประสงค์ที่บริเวณส่วนหัวสำหรับเช็ดทำความสะอาดทำมาจากเส้นใยที่มีไฟฟ้าสถิต สามารถโค้งงอได้อย่างอิสระ ทำให้ช่วยดักจับฝุ่น ขจัดคราบสกปรก และคราบน้ำมันออกจากพื้นผิวแข็งได้ง่ายด้วยน้ำเพียงอย่างเดียว และสามารถล้างซ้ำแล้วนำกลับมาใช้งานใหม่ได้อีก จึงเหมาะอย่างยิ่งสำหรับกำจัดสิ่งสกปรกที่เกาะอยู่ตามซอกมุมแคบหรือสถานที่สูงยากต่อการเข้าถึง […]

November 10, 2023

ฝุ่นเจ้าสิ่งจิ๋วแต่มีอันตรายใหญ่หลวง

November 10, 2023

ฝุ่นเจ้าสิ่งจิ๋วแต่มีอันตรายใหญ่หลวง

October 9, 2023

วิธีเลือกเครื่องดูดฝุ่นให้เหมาะกับการดูแลบ้าน

October 9, 2023

วิธีเลือกเครื่องดูดฝุ่นให้เหมาะกับการดูแลบ้าน

September 28, 2023

6 เครื่องมือช่างที่ต้องมีติดรถยนต์

September 28, 2023

6 เครื่องมือช่างที่ต้องมีติดรถยนต์

August 27, 2023

4 วิธีการเช็คว่ามีไฟฟ้าลัดวงจรหรือไม่?

August 27, 2023

4 วิธีการเช็คว่ามีไฟฟ้าลัดวงจรหรือไม่?

July 19, 2023

การเดินสายไฟที่ดีต้องรู้อะไรบ้าง?

July 19, 2023

การเดินสายไฟที่ดีต้องรู้อะไรบ้าง?